5 Reasons Why Customer Cash May Be the First Source of Funding for Startups

Raising cash from your customers to fund your new venture may be the better alternative to raise equity than pounding the pavement for investors, says John Mullins, Ph.D., a professor with the London School for Business.

Professor Mullins and his research team have identified five “customer funded” models that may provide the jumpstart for new businesses. He identifies them in his new book, aptly titled “The Customer-Funded Business: Start, Finance, or Grow Your Company with Your Customers’ Cash,” released this month by John J. Wiley & Sons.

Dr. John Mullins

photo credit: John J. Wiley & Sons.

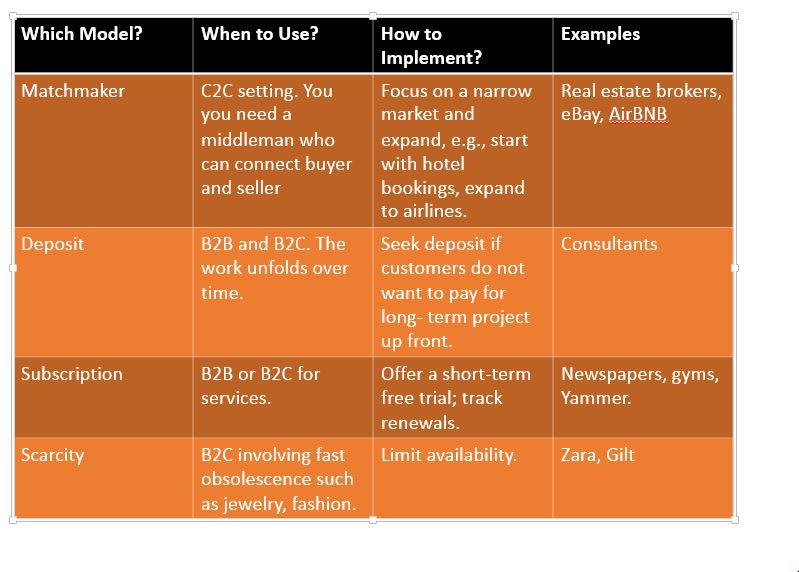

The five models include:

•Matchmaker models (for example, the U.S. companies Airbnb and DogVacay)

•Pay-in-advance models (the USA’s Threadless, India’s Via and Loot)

•Subscription models (India’s TutorVista, the USA’s H.Bloom)

•Scarcity models (Spain’s Zara, France’s vente-privee, the USA’s Gilt Groupe)

•Service-to-product models (Denmark’s GoViral, Puerto Rico’s Rock Solid Technologies)

Professor Mullins is an Associate Professor of Management Practice in Marketing and Entrepreneurship at London Business School. “First of all, getting customer funding isn’t new,” said Professor Mullins in an interview. “It’s exactly what Michael Dell, Bill Gates, and Banana Republic’s Mel and Patricia Ziegler did to get their companies up and running and turn them into iconic brands.”

“Many entrepreneurs fall head over heels in love with their product or technology, and they have a hard time distancing themselves enough to ask a fundamental question: Why will – or won’t – my idea work? A much more sure-footed approach is to get your customers to fund your business at the outset,” adds Professor Mullins. “If they do so, that’s the best news you can get, and a real confidence-builder, too. And if they won’t give you their money – by buying what you plan to sell – maybe you are on the wrong track.”

What are some examples of “customer funding?”

In a “Matchmaker” model, some companies’ entire business models consist of connecting buyers and sellers. eBay or Expedia is a good example. Because they simply take the order, but never own the goods that are sold, there’s no need to tie up cash in inventory.

For subscription models, the customer pays all — or part — of a delivery of goods or services over time. Subscription models are good for recurring revenue.

Scarcity models are those in which the item for sale is available only in limited quantities for a limited period of time, with the seller’s supplier being paid after the sale is made. For example, USA’s “Gilt Groupe” offers limited editions of jewelry, shoes, and handbags.

What about the investors?

Professor Mullins said his new book is geared as much to angel investors as startups. Why? “Angel investing can be hugely rewarding, but it’s very risky,” Mullins observed. “Most business angels who have been around for a while understand that. The book gives them a way to improve their odds – and those of the entrepreneurs they support, too. In each of the chapters there’s a checklist of questions which angel investors will – or should – ask.”

What about crowdfunding?

“Crowdfunding is all the rage today, but I think there’s a backlash looming, as projects and companies that were crowdfunded fail to deliver on time and on budget,” Mullins pointed out. “Raising money is actually the easy part of starting a new business, believe it or not. Getting the product right and finding the right customer who simply has to have it is much more difficult. And crowdfunding does little to address these issues.”

The book is available now through vendors such as Amazon.com, Google Play, and Barnes & Noble.

Expert Office Hours

Your Questions • Our Experts

Private Appointments

9:00 am – 12:00 pm

2024

| Fri Aug 16 | Fri Oct 25 | Fri Dec 13 | Thu Sept 19 | Thu Nov 14 |

Register 2-3 weeks in advance

Have Expertise?

Subscribe to Our Updates!

Why New Albany?

As a community created by innovators for innovators, New Albany offers a robust ecosystem that leverages entrepreneurship, business connectivity, public-private partnerships and quality of life to inspire creativity and accelerate commerce.