TIGER Talk Recap: Cracking the Small Business Loans Code

It’s every business owner’s hope that they can run their business from operating cash flow, but unfortunately that’s not always possible. When they need to secure business financing, how can they crack the code and determine the kind of loan that will best help them succeed?

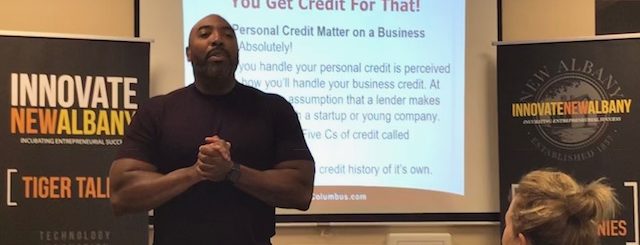

Jerome W. Jones is a business consultant with The Small Business Development Center and was Innovate New Albany’s TIGER Talk presenter on July 20. His presentation, “Cracking the Small Business Loans Code” gave business owners valuable tips to position themselves favorably for the types of loans they may need.

Jerome said the first thing business owners need to do is to have a business plan. He prefers to call it an action plan, because most people file a business plan in a drawer. The plan should be actionable — not just an idea — and is the business’ roadmap to success.

Funding Requests

When you are seeking funding for your small business, Jerome advises you include

the following:

- Your current funding requirements. Put together a cash flow projection

- Funding requirements for the next five years

- A sources and uses statement. Be as specific as possible about what you will use the money for, and where the capital will come from

- Future financial situational plans

You’ll also want to include a debt schedule, which accounts for all the debt obligations affecting a business and a timeline to meet those deadlines. Also include financial statements, a balance sheet, and financial projections. You should be prepared to supply financial projections monthly or quarterly for the first two years, then yearly through year five.

Application Checklist

For loan applications, Jerome says you will need to provide:

- three years of business tax returns

- three years of personal tax returns

- interim business financial statements not more than 90 days old

- two to five years of financial projections (monthly for the first two years)

- a personal financial statement

Since the business is new and has no credit of its own yet, Jerome says that personal credit matters. Most lenders assume that how you handle your personal credit is how you will handle your business credit. Collateral is a requirement of most lenders and is a sound lending practice. It’s also considered a secondary source of

repayment should the business fail to meet its obligation. Depending on the lender

many things can be used as collateral.

Jerome says most lenders will expect you to inject 10% – 20% of personal equity into your business. This is your “skin in the game” and can be cash on hand or verifiable purchases.

The most important factor in a business plan is cash. Cash is king. If a business can’t repay the loan nothing else matters, so you must demonstrate that you can in your business plan.

Funding/Loan Options

Jerome explained the following funding options for new business owners:

Bootstrapping. This is how most businesses get started, and it is your personal or retirement savings, borrowing from friends and family, or using credit cards.

SBA Funding Options. The SBA offers a SBA 7 (a) loan guarantee that can be used for anything for up to 25 years. The SBA 504 Loan Program is for real estate and large equipment.

Microloans. These loans are for up to $350,000 for equipment, inventory, and working capital. The rates are determined by the funding source, and the term is up to five years with a 10% down payment.

Finance fund. This is community development lending for real estate, equipment and working capital.

Certified Development Companies. These include SBA 504 Loans, State of Ohio 166 Loans, and the City of Columbus Loan fund.

United Midwest Savings Bank. This includes working capital loans up to $150,000 and unsecured loans up to $25,000. There is a 10 year term and tiered interest rates. Kiva. These are social lending loans up to $10,000. There is 0% interest, no collateral required, a two-year term for under $5,000, and a three-year term for $5,000 – $10,000. It is not credit score driven.

Crowd Funding. This includes programs such as Kickstarter, Indiegogo, and GoFundMe.

SBDC Microloan Fund. These are microloans of up to $10,000, with competitive interest rates and terms up to 5 years.

For more information on cracking the small business loans code and securing funding for your business, contact Jerome at jjone110@cscc.edu.

TIGER Talks are offered free of charge each month, and educate business owners on the topics of technology, innovation, growth, entrepreneurship and responsibility. If you’d like to learn more about upcoming TIGER Talks, please visit Innovate New Albany’s website.

Expert Office Hours

Your Questions • Our Experts

Private Appointments

9:00 am – 12:00 pm

2024

| Fri Aug 16 | Fri Oct 25 | Fri Dec 13 | Thu Sept 19 | Thu Nov 14 |

Register 2-3 weeks in advance

Have Expertise?

Subscribe to Our Updates!

Why New Albany?

As a community created by innovators for innovators, New Albany offers a robust ecosystem that leverages entrepreneurship, business connectivity, public-private partnerships and quality of life to inspire creativity and accelerate commerce.