Your Business Idea Sucks and So Does Your Tie

Hard to hear, isn’t it?

Chances are the grand idea that you thought up to create a brand new business completely, totally, and utterly sucks. You are not alone. Most new business ideas do suck and the ones that get past this-idea-doesn’t-suck-stage, that get funded, and then successfully launch, actually fail after five years of operation. Not the best odds, but it beats the lottery, most games at the casino, getting struck by lightning, getting hit by a piece of re-entering debris from on old soviet spy satellite, or other highly improbable events.

Now none of my ideas are any better than yours, except for my idea of writing this blog post, which after all, you just clicked on to make yourself a wiser and better entrepreneur. Anyway, I come from the angle that all business ideas suck until you prove that they don’t. The evaluation is like a European court: you’re guilty until proven innocent. This method actually makes a lot of sense because this is how many venture capitalists, loan officers, and investors look at business ideas. You need to do your homework to see if there is a market need and that your business idea fills that need in a unique way before you can prove that your idea does not suck.

Sounds easy, and it really is; provided you follow these easy steps that someone else developed, I stole, and put into this post. Actually, these are traditional steps that you should go through to evaluate your idea to see if it has a shot at becoming a viable business. In an entrepreneurial world where there is an emphasis on being innovative and cutting edge, the process of looking at the viability of your business hasn’t changed for some time, just the access to the data has. What held true for Henry Ford when he built his business still holds true for yours.

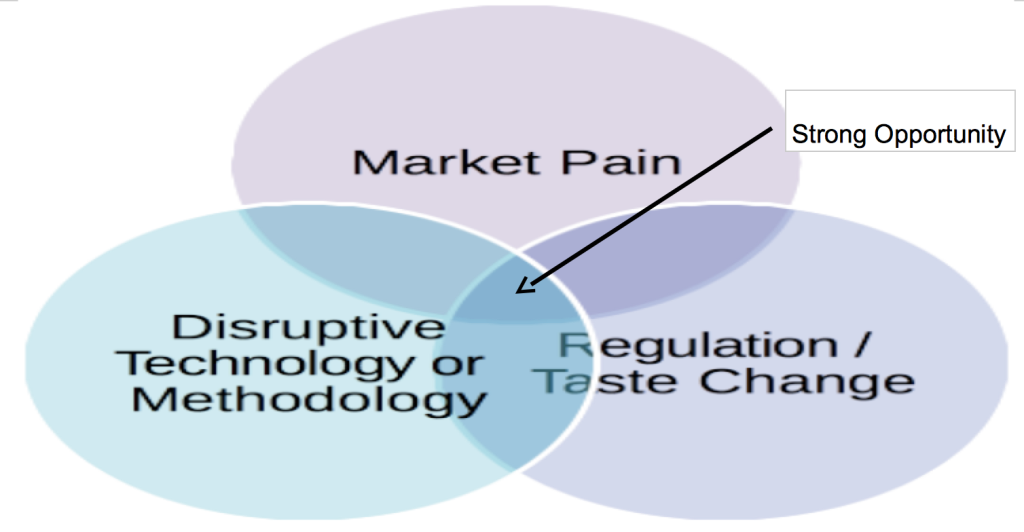

So how do you decide if your idea should emerge from the realm of suckage? Well, you need to look at the opportunity in the market. The diagram below gives you an idea of where an opportunity might exist in the market for a business idea to take root and exploit the opportunity. Exploit sounds like a bad word, doesn’t it? You don’t want to exploit people, right? Sounds like slave labor and low wages, but in the true sense of the word, you actually want to turn something to practical account; take an opportunity and make some money. This is one of the biggest things you need to prove to make your idea not suck.

I’ve seen many a business plan be a solution in search of a problem. If there is no problem, there is no opportunity to solve it. No opportunity, nothing to exploit, no money to be made, no potential for the business idea to flourish. Venture capitalists, investors, and banks will sniff this out first and if you don’t have it, don’t expect a call back or any money for your idea.

This is an oversimplified diagram, but here is the idea. If there is a market pain and you are thinking of doing something unique and there is a change in the environment, then you have a very strong opportunity identified. I am not saying there isn’t an opportunity if you are doing something in a new way that is solving a program or starting a new business because of an underserved change in the environment, just that the opportunity won’t be as strong. The other part of the opportunity is defining how big it is. Chances are you are not going to get investors if the opportunity is really small or doesn’t have a chance at growing. You really have to get a good idea of how big the market is and if it is growing or not. One of my favorite quotes from the 1991 movie, Other People’s Money, has Danny DeVito’s character addressing a group of shareholders as he attempts a hostile takeover of a company.

“Obsolescence. We’re dead alright. We’re just not broke. And you know the surest way to go broke? Keep getting an increasing share of a shrinking market. Down the tubes. Slow but sure. You know, at one time there must’ve been dozens of companies making buggy whips. And I’ll bet the last company around was the one that made the best goddamn buggy whip you ever saw. Now how would you have liked to have been a stockholder in that company? You invested in a business and this business is dead. Let’s have the intelligence, let’s have the decency to sign the death certificate, collect the insurance, and invest in something with a future.”

The worst case is entering in a market that is in decline. I doubt you want to start a DVD making business now that it is almost dead. Everyone is moving away from physical media and into cloud-based storage. Like Larry the Liquidator, early stage investors are generally very keen on what industries are potential winners and which ones are losers. Pay attention to the feedback or lack of feedback you get from these people. They are another way to help validate that you have an opportunity worth exploiting in the market.

Expert Office Hours

Your Questions • Our Experts

Private Appointments

9:00 am – 12:00 pm

2024

| Fri Aug 16 | Fri Oct 25 | Fri Dec 13 | Thu Sept 19 | Thu Nov 14 |

Register 2-3 weeks in advance

Have Expertise?

Subscribe to Our Updates!

Why New Albany?

As a community created by innovators for innovators, New Albany offers a robust ecosystem that leverages entrepreneurship, business connectivity, public-private partnerships and quality of life to inspire creativity and accelerate commerce.